EU VAT

Permalink EU VAT Checkout

The EU VAT add-on allows you to set fixed retail prices for consumers in the EU. The VAT included in the prices automatically adjusts to the tax rates of the buyer’s country.

Permalink Add-on Activation

You can activate the add-on in the menu

“WooCommerce -> German Market -> Add-ons“.

It has the name “EU VAT Checkout“.

After activation the add-on gets its own menu, which you can find under

“WooCommerce -> German Market -> EU VAT Checkout“.

Permalink Requirements

EU VAT is designed for consumer business (B2C) and therefore requires enabled VAT calculation in WooCommerce, as well as displaying prices in the cart and at checkout including VAT.

For the add-on settings to take effect, the setting

“WooCommerce -> Settings -> Tax -> Prices entered with tax”

must be set to the option “Yes, I will enter prices inclusive of tax“.

To ensure that the tax rates are applied correctly, make sure that you also calculate your taxes based on the country of delivery of your customers. You can set this in WooCommerce with the setting

“WooCommerce -> Settings -> Tax -> Tax options -> Calculate tax based on“.

Permalink General Tax Settings

If you want the gross prices in your store to always stay constant, even if different VAT rates are applied depending on the customer’s destination country, you will find in the setting

“WooCommerce -> German Market -> EU VAT Checkout -> General -> Fix Prices”

several options to implement this.

Disable

If this option is selected, then no fixing of gross prices will take place.

Enable for all products

If this option is enabled, then the gross price will be fixed for all products, regardless of the destination country.

Example:

Germany: 119 Euro contains 19% VAT

Austria: 119 Euro contains 20% VAT

USA: 119 Euro (without VAT)

Enable for all products, for EU countries

If you choose this option, the gross prices will be fixed for all products, if the destination country is an EU member state.

Example:

Germany: 119 Euro contains 19% VAT

Austria: 119 Euro contains 20% VAT

USA: 100 Euro (without VAT)

Enable for downloadable products, for EU countries

If this option is selected, the prices will be fixed only for downloadable products and only if the destination country is an EU member state.

Permalink Import EU Tax Rates

Using this submenu, you can import the tax rates of the EU member states into your existing WooCommerce tax classes.

In the menu

“WooCommerce -> Settings -> Tax -> Tax Options”

you can add additional tax classes with the setting “Additional tax classes” (besides the default tax class). For example, you may have already entered a tax class for reduced tax rates here.

You can do the import in the menu

“WooCommerce -> German Market -> EU VAT Checkout -> Import EU Tax Rates“.

With the setting “WooCommerce tax class” you select the tax class created in WooCommerce to which you want to import the tax rates. With the setting “Tax rate to be imported” you select the dataset of tax rates you want to import.

Finally you can decide with a switch if you want to delete already existing tax rates in the existing tax class before the import. If necessary, you should save the existing tax rates before.

Example:

You participate in the OSS procedure and want to import the corresponding standard tax rate for each EU member state in the standard tax class. Then you select the option “Standard” in “WooCommerce tax class” and in the setting “Tax rate to be imported” you select “Standard EU rates”. For the reduced tax rates you can proceed analogously.

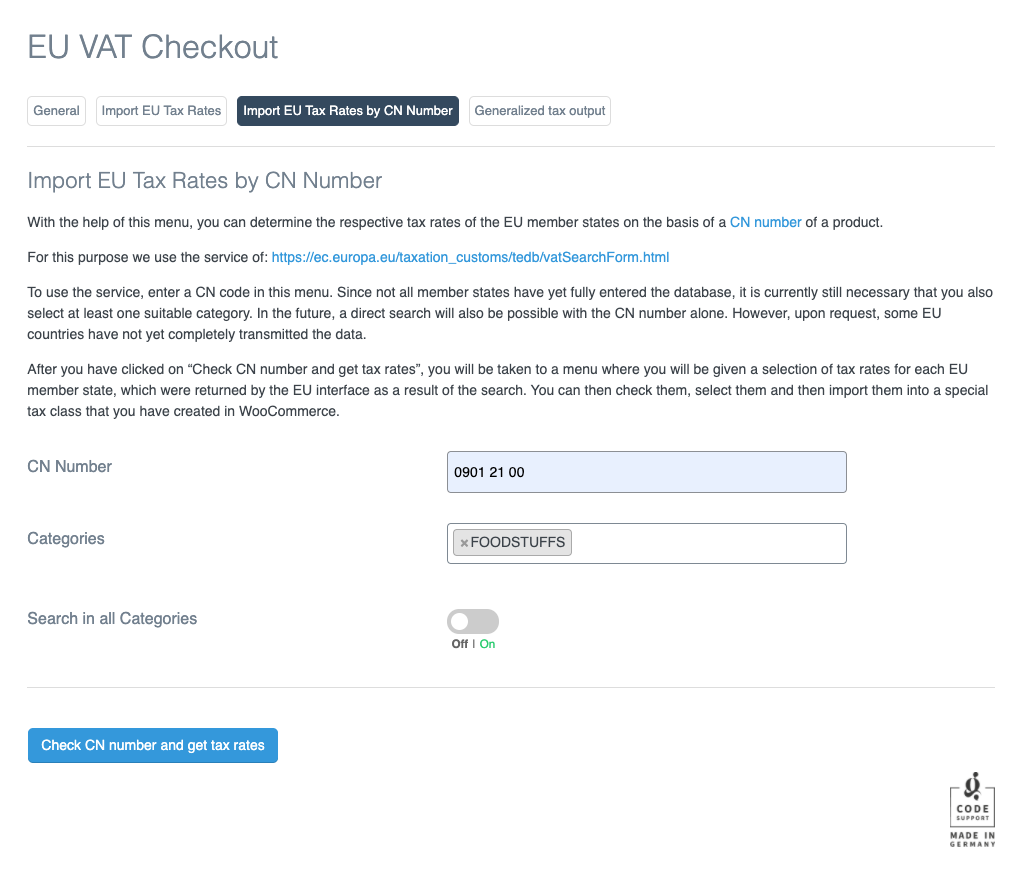

Permalink Import EU Tax Rates by CN Number

With the help of this menu, you can determine the respective tax rates of the EU member states based on a CN number (Combined Nomenclature) of a good.

For this purpose, the service of https://ec.europa.eu/taxation_customs/tedb/vatSearchForm.html is used.

This interface provided by the EU has not yet been fully populated by all EU member states. Therefore, it may be that only the standard tax rates are returned when searching for a specific CN number. Therefore, it is currently still necessary or recommended to always have at least one category selected in the search. Unfortunately, we have no influence on this. We hope that in the future the input of a CN number will lead to a unique tax rate per EU country as a response.

In the first step you enter a CN number, select no category (currently not recommended), one category or several or all categories. Then click on the button “Check CN number and get tax rates”.

After you press the button, a new page content will be loaded.

In this menu you will see a selection field for each EU member state, in which each option represents a tax rate that was returned by the EU server as a response to the search query regarding the CN number. Additional information is included for each option. Check this information and select the correct tax rate. If you see an exclamation point next to the country name, there are multiple tax rates to choose from.

Furthermore, you can then select the tax name for each EU member state. This tax name will then be used in the selected tax class of WooCommerce.

In the bottom part you can select the tax class of WooCommerce to which you want to import the selected tax rates.

Permalink Generalized Tax Output

By default, the VAT is output by German Markt as follows: “Includes € 1.99 VAT. (19%)“.

If you want to simplify the output, you can find the corresponding option under

“WooCommerce -> German Market -> EU VAT Checkout -> Generalized tax output“.

You can specify yourself exactly what the output should be. The default setting here is “Incl. tax.